2019 annual contribution limits for eligible tax filers:

401(k), 403(b), most 457 plans, and Thrift Savings Plan is increased from $18,500 to $19,000.

IRA contributions increased from $5,500 to $6,000 per year. The age 50+ catch-up contribution limit remains at $1,000.

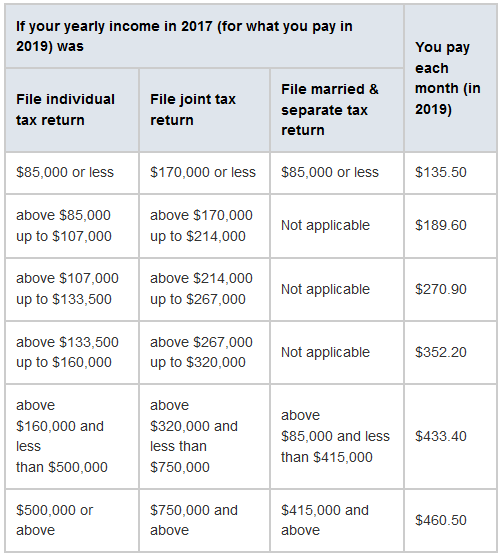

Tax deduction and Income limitations for 2019:

Taxpayers can deduct contributions to a traditional IRA if they meet certain conditions. If during the year either the taxpayer or their spouse was covered by a retirement plan at work, the deduction may be reduced, or phased out, until it is eliminated, depending on filing status and income. (If neither the taxpayer nor their spouse is covered by a retirement plan at work, the phase-outs of the deduction do not apply.) Here are the phase-out ranges for 2019:

If single or joint married taxpayers are not covered by a work retirement plan, they may fully deduct traditional IRA contributions. Other tax filers may partially or fully deduct contributions if they meet the below exceptions:

- Single taxpayers covered by a work retirement plan, can fully deduct if modified Adjusted Gross Income (AGI) is below $64,000. A partial deduction is allowed if modified AGI is between $64,000 to $74,000

- Married Joint taxpayers, where the spouse making the IRA contribution is covered by a workplace retirement plan, can fully deduct if modified AGI is below $103,000. A partial deduction is allowed if modified AGI is between $103,000 to $123,000

- Married Joint taxpayers, where the spouse making the IRA contribution is not covered by a workplace retirement plan, but the other spouse is, can fully deduct if modified AGI is below $193,000. A partial deduction is allowed if modified AGI is between $193,000 to $203,000

The Modified AGI phase-out range for Roth IRA contributions is $122,000 to $137,000 for singles and heads of household, $193,000-203,000 for married couples filing jointly.